by Spark Payments

Share

by Spark Payments

Share

Comprehensive Guide to Smoke Shop Payment Processing

Introduction to Smoke Shop Payment Processing

In the rapidly evolving world of retail, smoke shops face unique challenges, especially when it comes to payment processing. This guide is designed to provide an in-depth understanding of the intricacies of payment processing tailored for smoke shops, ensuring seamless transactions and enhanced customer satisfaction.

Understanding the Smoke Shop Industry

Market Dynamics and Challenges

The smoke shop industry, encompassing both traditional tobacco products and modern alternatives like vaping products and accessories, is subject to stringent regulations and a constantly shifting market landscape. These factors significantly impact how payment processing is managed within the industry.

Importance of Specialized Payment Processing

Due to the high-risk nature of the industry, conventional payment processors often shy away from providing services to smoke shops. Specialized payment processors are crucial as they understand the regulatory environment, the risk factors, and the specific needs of smoke shop businesses.

Key Features of an Ideal Payment Processor for Smoke Shops

High-Risk Merchant Account Services

Smoke shops require high-risk merchant accounts to handle their transactions. These accounts are designed to manage the higher levels of scrutiny and the potential for chargebacks that are prevalent in this industry.

Secure Payment Gateway Integration

A secure payment gateway ensures that all transactions are encrypted and protected from fraud. This not only safeguards the business but also instills confidence in customers.

Comprehensive Fraud Prevention Tools

Effective fraud prevention tools are essential. These include advanced security measures such as Address Verification Service (AVS), Card Verification Value (CVV) checks, and robust fraud detection algorithms.

Flexible Payment Options

Offering a variety of payment options, including credit and debit cards, e-wallets, and alternative payment methods, caters to a broader customer base and enhances the shopping experience.

Compliance with Regulatory Requirements

Staying compliant with federal, state, and local regulations is critical for smoke shops. A good payment processor will ensure that all transactions adhere to these regulations, thereby minimizing the risk of legal issues.

Steps to Set Up Payment Processing for Smoke Shops

1. Choose a Reputable High-Risk Payment Processor

Selecting a payment processor with experience in handling high-risk accounts is the first step. Look for one with positive reviews, transparent pricing, and excellent customer support.

2. Apply for a High-Risk Merchant Account

Complete the application process for a high-risk merchant account. This typically involves providing detailed information about your business, including its financial history and compliance with industry regulations.

3. Integrate a Secure Payment Gateway

Work with your payment processor to integrate a secure payment gateway into your point-of-sale (POS) system and e-commerce platform. Ensure that it supports all necessary payment methods and is equipped with fraud prevention tools.

4. Train Staff on Payment Processing Procedures

Proper training for staff on the use of the payment processing system is essential. This includes handling transactions, recognizing potential fraud, and ensuring compliance with regulations.

5. Monitor and Optimize

Regularly monitor your payment processing system to identify and address any issues promptly. Optimizing your system for efficiency and security will help maintain smooth operations and enhance customer satisfaction.

Benefits of Using Specialized Payment Processing for Smoke Shops

Enhanced Security

Specialized payment processors provide enhanced security features tailored to the high-risk nature of smoke shops, reducing the likelihood of fraud and chargebacks.

Improved Customer Experience

By offering multiple payment options and ensuring quick, secure transactions, smoke shops can significantly improve the customer experience, leading to increased loyalty and sales.

Regulatory Compliance

Staying compliant with industry regulations is simplified with a specialized payment processor, reducing the risk of fines and legal complications.

Increased Approval Rates

High-risk merchant accounts typically have higher approval rates for transactions, ensuring that more sales are successfully processed.

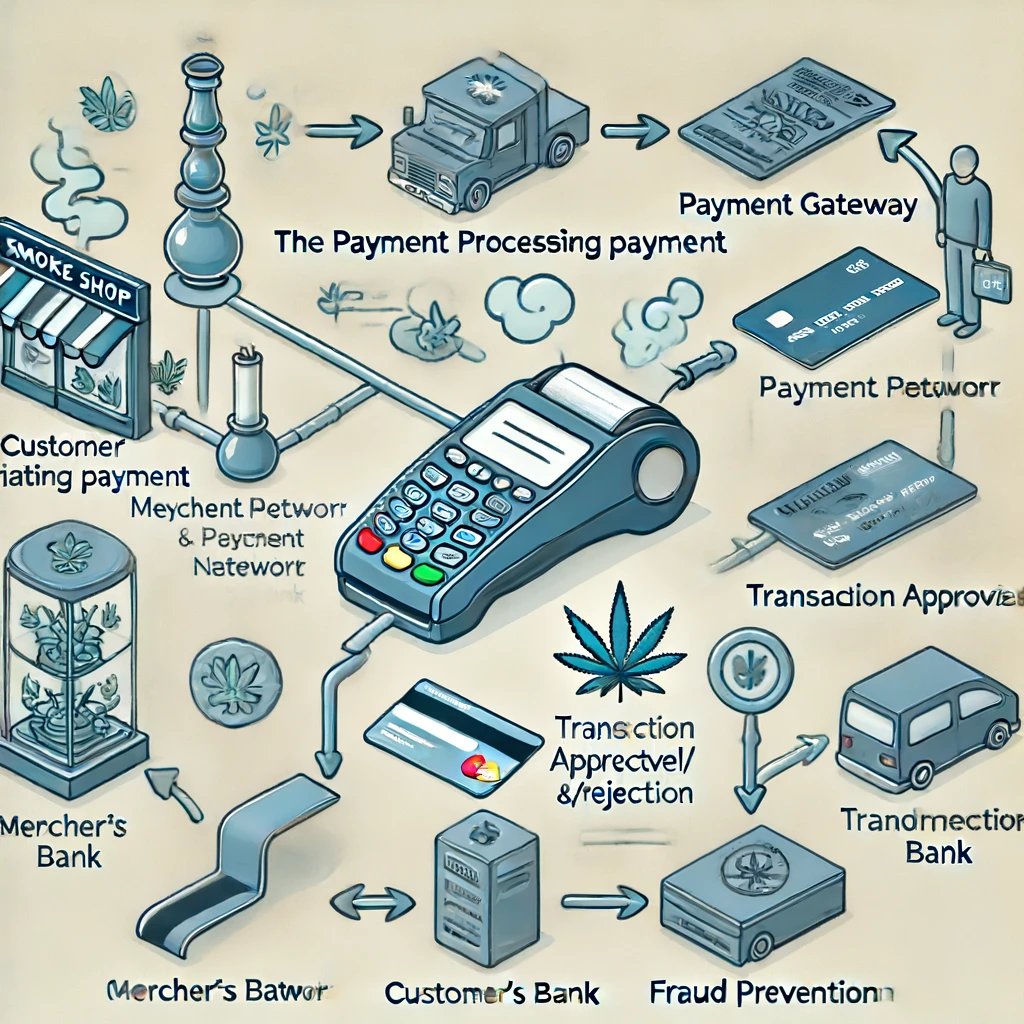

Diagram: Payment Processing Flow for Smoke Shops

Conclusion

Effective payment processing is a cornerstone of successful smoke shop operations. By partnering with a specialized high-risk payment processor, smoke shops can ensure secure, compliant, and efficient transactions, ultimately leading to a better customer experience and increased business growth.

For smoke shop owners, staying informed and proactive about payment processing solutions is not just a necessity but a strategic advantage in a competitive market.

Finding a gun friendly credit card processor is essential for firearm businesses operating in a high-risk industry. This article outlines practical solutions for choosing a processor that is compliant, understands the unique demands of the industry, and integrates with specialized software to streamline your operations. Key Takeaways Firearms businesses require specialized gun-friendly credit card processors

Securing a vape friendly merchant account is key to a successful vape shop, especially considering the industry’s high-risk status. This article delivers straightforward guidance on choosing a merchant account provider that meets your unique needs, from tackling regulatory challenges to minimizing chargeback rates. Gain insights on what features to look for and how to ensure

Grasping the concept of merchant services PCI compliance is vital for each and every business that processes card payments. This key security measure is obligatory to protect sensitive card data and steer clear of severe fines. Our guide cuts through the complexity, providing a straightforward walkthrough of PCI DSS requirements, how to achieve compliance, and

What are merchant services? They are the backbone of payment processing for businesses, allowing seamless transactions via credit, debit, and electronic payments. In this article, we will clarify how these services work, the variety they come in, and their role in your business’s financial ecosystem. We’ll guide you through selecting a merchant services provider without